Bitcoin price hits the dreaded stall, but there’s a massive silver lining

Bitcoin's record low volatility session broke to the downside, but haste makes waste and patience is a virtue. Let's explore the current generational buying opportunity.

Those who smoke meat will know all about the stall.

It’s a point in the cooking process where the temperature hits a plateau and holds in the 150 to 170 Fahrenheit zone and it can last for hours. Basically, the meat is going through a process of evaporative cooling as it sweats out its moisture and this causes the temperature to settle into a temporary stasis.

Briskets stall, pork butts stall, heck, even a large turkey can hit the stall and delay dinner by hours.

Bitcoin’s stall took much longer than investors expected and after the recent bout of record-low volatility, price took the route to the downside.

Obviously, this was unpleasant for traders with a bullish bias and to put it in the context of smoking meat, losing core temp during the stall is a bit of a disaster, but undercooked beef is easier to fix, whereas overcooked beef means dinner is toast.

What I’m saying is there’s a silver lining to Bitcoin’s recent market structure breakdown.

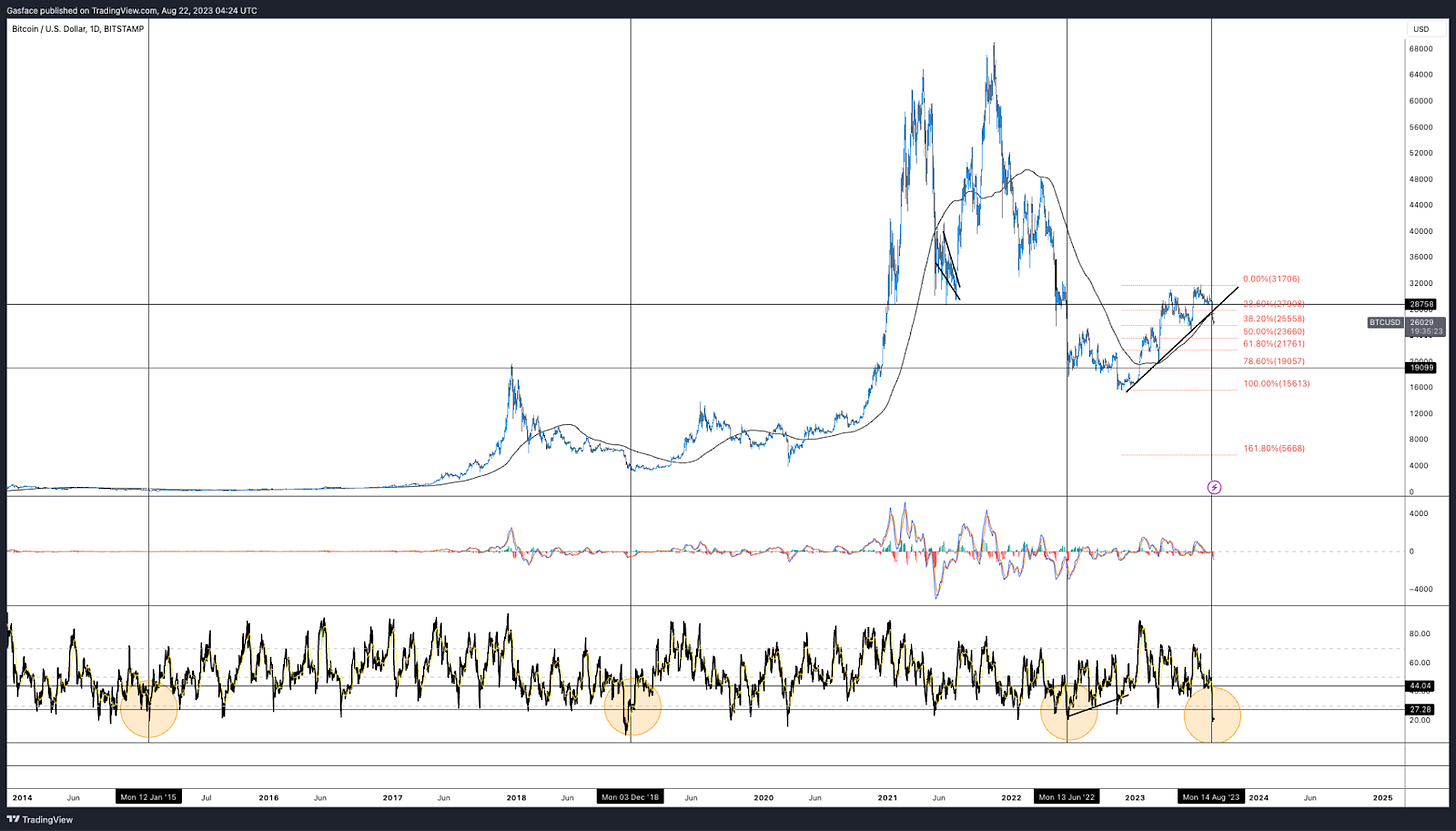

Bitcoin’s daily RSI dropped to a rarely visited level below 20 as price collapsed to $25,000 last week and many analysts have cited the phenomenon as a reason to go ape in the current price zone (ie, they view BTC as trading at a discount).

The daily timeframe RSI has only dropped below 20 four times in BTC’s history. In 2015, 2018, 2022 and now August 2023. Price had become deeply oversold and the chart doesn't lie. Go ahead, line up those sub-20 RSI events with a daily chart and see what happened down the road. Deep value, generational buy opportunities that rarely present themselves.

Now, with that said, do I expect more downside? Yes I do, but do I think BTC is in accumulation territory?

Yes, I also do.

The drop to $25K may have knocked Bitcoin price off 1 standard deviation from its mean price, but:

Price is below the 200 day moving average for the first time since January and it’s always a hard slog flipping the 200-MA to support if price closes under the MA for too many days

Losing the 200-MA tends to mark a trend breakdown and some alteration of the market structure on the higher time frame

The structure of consecutive bull flags, an ascending trendline and daily higher lows on the daily time frame was also broken by the drop to $25K

The most immediate support is at $23.6K (where everyone is apparently waiting to buy) and if this breaks, then a bounce off the golden pocket at the 61.8% Fib level at $21,800 is a structural support dating all the way back to July 2022. Below that, barring some crazy macro and crypto event, there’s also $19K as the kind of “final line” in the sand.

Given these red flags, the deeply oversold RSI on the daily time-frame might not be the ultimate determinant of a sell-off bottom. In fact, there is likely more downside, a point illustrated by the weekly timeframe.

Yes, the RSI was deeply oversold on the daily timeframe and as recent as Aug. 23, appeared to be in the process of an oversold bounce, but on the weekly timeframe chart above, we can see the metric hovering around a multi-year midline, with more extreme lows being made in 2015, 2018, and 2022.

Obviously, technical analysis shouldn’t be applied and acted on in pure isolation, so investors will need to search for confluence by investigating other indicators, looking on-chain and analyzing futures and options markets data.

The simple point of today’s analysis is to identify the current buying opportunity in Bitcoin, while also cautioning that macro-specific and crypto-specific factors could easily catalyze further downside to the price levels mentioned earlier.

This week we’ve got

Jackson Hole, where the Fed’s view on a range of topics, including interest rates, inflation and the health of the US and global economy will emerge and set the tone of markets going forward in the short-term.

Soaring yields on treasuries

A pause in the US equities rally

Credible FUD about Binance’s solvency and current legal woes

There’s plenty of black swans and sell-off catalysts on the horizon and given the near stagnant inflow and tight liquidity in the crypto market, it only takes a small event to trigger a volatility spike.

Sounds quite similar to the volatility spike we saw last week doesn’t it?

Stalls don’t last forever

Regardless of how long “the stall” takes, maintaining the smoker’s fire and temp at a steady 225 to 275 degrees eventually pushes the bulk of moisture out of the brisket, rendering the tougher fats and bringing the temp closer to the 195 to 203 degree range that marks the completion of probe tender brisket.

In the short-term, Bitcoin price is likely to remain volatile, and negatively impacted by stringent anti-crypto regulation and the tightening of liquidity in the U.S. economy.

Despite this, the real alpha is in zooming out, looking at the historical precedent set by previous market cycles and remembering that as an asset, Bitcoin is entirely different from the U.S. dollar which is constantly losing value through a policy of central bank dilution.

Beyond a handful of metrics showing Bitcoin price trading at a discount, it's also worth remembering that the infrastructure for heavy institutional investment into Bitcoin has been laid and whether it be 3 months or 3 years, the eventual approval of a spot Bitcoin ETF is coming.

Keep your heads and be easy my friends.

If you enjoyed this article, then why not subscribe to my Substack, follow me @big_smokey1 .

To access more content like this, you can also find me weekly at Cointelegraph where I weekly markets column that publishes on Friday or Saturday of each week.

The views expressed here are not intended to serve as trading advice. The author is not paid to analyze any of the assets mentioned above and know that I may or may not hold positions in the mentioned assets. Please be safe and DYOR.

If you feel like donating here is how and where:

Bitcoin Lightning Network:

Bitcoin Segwit:

Ethereum / USDC / USDT:

Friend.tech codes so you can get more followers there:

ft-csfdkumq

ft-04g96156

ft-80kkj7uo

ft-z5lf1byi

ft-q81k10ld

ft-ex854a11