There’s a handful of similarities between investing in the crypto market and BBQ’n.

When smoking meat, an absolute error to avoid is throwing a cold brisket, pork shoulder or picanha on a hot grill.

The key is to pull the meat from the fridge a few hours in advance and let it come up to room temp.

If you’re smoking a brisket, pork shoulder, or any large piece of meat that weighs more than 3.5 pounds, you had better pull it out the freezer at least 2 or 3 days in advance because cooking cold meat basically means that you’re in for a tough, undercooked, bark-less, done on the outside and raw on the inside meal.

Nobody wants that.

That’s why it’s essential to plan well ahead when preparing for a cook-off. Get the wood logs busted into even splits, make sure the briquette reserves are sufficiently topped up, check the weather a few days in advance and make sure you’ve got all your rub seasoning.

Plan out your day, total cook time, and then add at least 3 hours for unexpected challenges and at least 1 hour for resting if it's a pork butt and even more if it's a brisket.

Smoking meat is no different than investing in crypto.

You’ve got to let it thaw, come to room temp, apply the rub, let it set for an hour, then hit the grill.

To apply this to crypto:

When in a bear market, let the price action flatten out and show signs of consolidation, then as longer-term consolidation trends are beginning to breakout above levels of resistance, start deploying capital into well researched assets and once a few weekly higher highs are hit, then it's time to become more active and play the strongest trends.

At the time of writing, despite all the regulatory actions against crypto and the fresh news that Binance also has some FTX Ponzi-scheme-like business practices, Bitcoin price is up 72% for the year. We might not be out of the bear market just yet, but the coals are hot and the smoker is coming up to temp.

Let’s review some of the previous trades in play, and look at a few other interesting assets that are exiting their consolidation phases.

Trying to reach that higher high

Bitcoin is pretty basic and that’s kind of what makes it an easy asset to trade. While price has recovered well since the $15,600 bottom, flipping $29,000 - $30,000 from support to resistance is proving to be a challenge, but I think everyone expected $30K to be a tough nut to crack.

Basically, BTC needs to make a weekly higher high above $35,000 (black dotted line) to (in my view) confirm a more definitive trend change and signal that the absolute worst part of the bear market is over. Until then, it’s basically just chop and consolidation.

Like I mentioned earlier, after the sharpest price drops from a bear market end, assets enter a phase of consolidation, where prices are range bound and chop along without much deviation for weeks, or sometimes months.

This is quite similar to what we see with $JOE. After months of consolidation, daily trading volume began to uptick and price followed. While consolidation patterns are alluring, more than 95% of altcoins have identical charts so beyond price action, it’s important to keep updated on other factors like network activity, liquidity incentives and roadmap developments to see if a convergence of technical and fundamental factors warrant opening a position.

Recently, Trader Joe launched a v2 of its DEX, which is called Liquidity Book. The platform uses a concentrated liquidity design (like Uniswap v3) and it’s become quite sticky over the past month. The DEX is multi-chain, with Arbitrum, BNB Chain and Avalanche available and due to its concentrated liquidity distribution model, liquidity providers have more options on how to manage and withdraw their deposits and swaps are more efficient and cost less.

According to Delphi Digital:

“As they move towards the concentrated liquidity DEX model, they’ve started to attract more volume and generate more fees. Since LB’s launch and their expansion to Arbitrum, their volume started trending up, hitting highs of $100M in daily volume on March 11th, 2023 after being stagnant at the end of 2022. This reignited volume and led to them generating $6.08M in fees for LPs year-to-date.”

That’s all good and well, but I’m more of a trader than a DeFi liquidity provider, so here’s what caught my eye.

If you take a look at Trader Joe on Arbitrum, the liquidity pools there have high yield, high TVL, and lots of daily volume. $ARB and Arbitrum are all the rage since the airdrop hit, and with less than 13% of the total token supply in circulation, in my opinion, there are reasons for holders to not dump the airdrop on a CEX for a quick dolo flip.

Which is possibly why whales and smart money have been accumulating $ARB…

As you can see in the chart above. Liquidity Book has become quite sticky and the ARB / JOE pools are pretty sticky too.

Whales and market makers who received a ton of ARB for free and are already serious ETH (WETH) and stablecoin holders can derive more profit from yield and future fee sharing on sJOE than the short-term gain of just dumping $ARB. Not to mention, these same smart investors can hedge their ARB spot exposure by using perpetual contracts at an exchange.

Now, a quick moment for ARB. Imagine if all the DAOs and DeFi platforms see what’s happening over at Trader Joe’s Liquidity Book and launch similar incentives with lucrative ARB pools. Uniswap’s licence does expire on April 1, meaning it’s open season for innovative DeFi primitives that can now roll out clones of Uni v3’s features. Everyone wants a share of Uniswap’s market share, and it’s possible that ARB could temporarily be the conduit that attracts and directs flow.

With the majority of ARB airdrop sell pressure possibly expended, it’s possible that the asset could possibly defy the common outcome of “airdropped governance token going to $0.” Just a thought eh.

So back to JOE. It’s sticky and increased DEX volumes and the recent launch of a perp contract at ByBit have been beneficial to its price action.

A massive uptick in JOE LP’n in Arbitrum and soon to come BNB Chain pools will also eventually spin up fee share that is kicked back to sJOE stakers.

Typically, this translates to an uptrend in an asset’s price, similar to what we’ve seen with JOE which has pulled off a 350% gain since January.

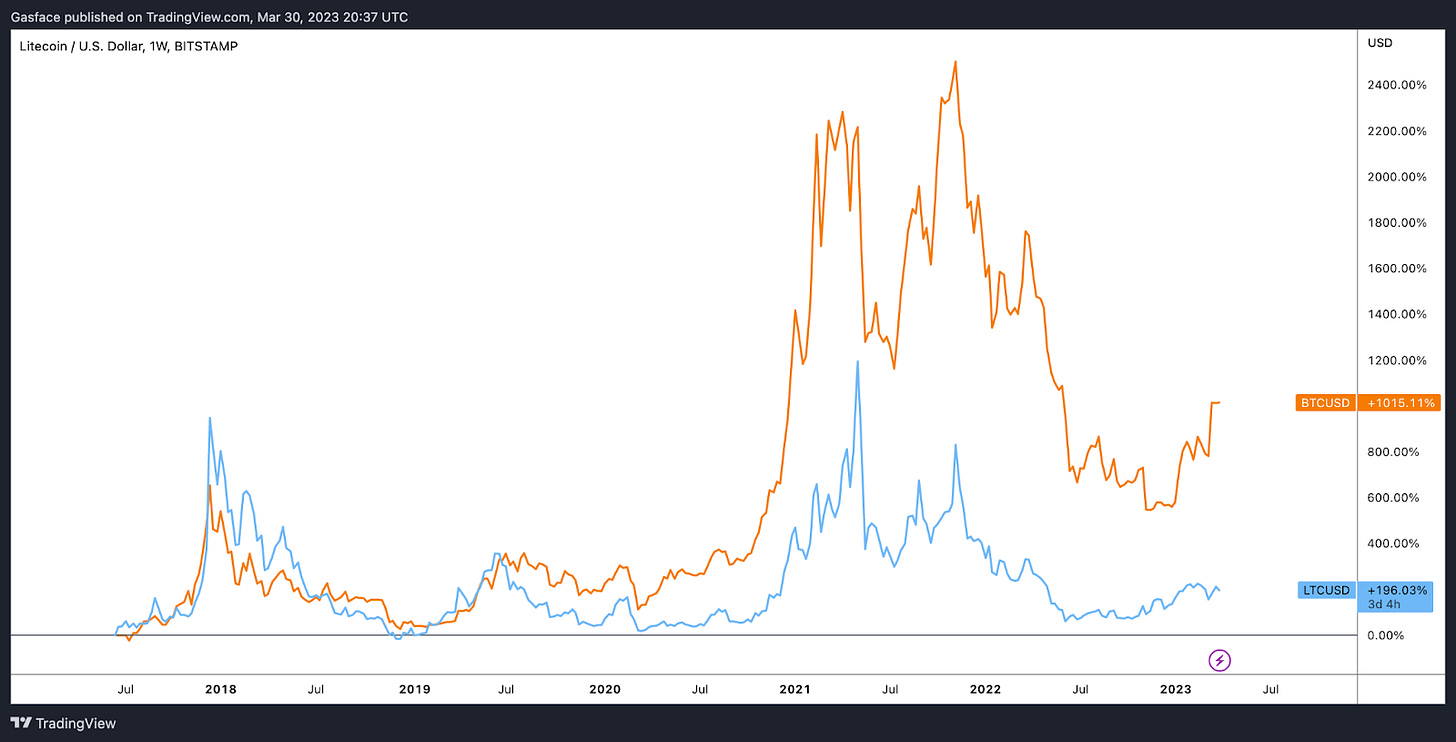

Litecoin follows the pre-halving narrative

As an update on LTC, which we’ve been tracking for like 6 months now, all is gravy and the pre-halving narrative remains in effect. LTC price continues to trade above the weekly moving averages and trendline-wise, follows a similar price trajectory seen in previous halvings (marked by the vertical black lines).

There’s really not much else to say here, and adding to the running LTC position on major dips has been fruitful.

Now, if you’ll humor me and allow me to put on my tinfoil hat.

Personally, LTC is an interesting trade from the perspective of perpetuals, but I’ve not felt any urge to be spot long on the token.

I began to think differently this week. Specifically, I wondered if LTC is more than just an analogue of BTC…

It’s proof-of-work, will have future halvings and tends to track BTC price, especially in hype cycles.

The CFTF lawsuit against Binance and Changpeng Zhao also recognizes LTC as a commodity, alongside BTC, likely because it is a direct hard fork of Bitcoin.

So, while LTC has not seen much success as a payment rail or store of value, one might assume that if, and as, BTC price roars to new all time highs and sees widespread institutional investment and adoption, that new use cases and value accrual narratives could spring up around LTC.

If 1 BTC is $100,000 one day, what might 1 LTC be worth, in comparison to its current sub-$100 value?

Because of when its halvings are, LTC tends to be an early mover compared to BTC price, and it tops out a bit earlier than BTC price, which is something I discussed in a previous article taking a more granular look at LTC’s price potential.

While data supports the likelihood of a sell-off after the LTC halving, depending on the narratives that spin up around it, it could still be one to keep an eye on.

Ethereum stays on track

Ethereum is also still on, following the price trajectory we’ve focused on in the past few months. $1,800 to $1,900 remains a bit of a difficult resistance level and the market needs to see $1,900 flipped to a firm level of support before ETH can explore the $2,000 to $2,500 price zone.

With the Shapella upgrade scheduled for April 12, we could see an uptick in shorts as certain analysts forecast a sell-off as investors have the option to unstake their tokens, but I believe that with the allure of liquid staking derivatives offering juicy yields, the sell-off might not be as sharp or prolonged as ETH bears expect.

Here’s the total amount of ETH staked to the ETH2 deposit contract. Yes, that’s 17.9 million ETH, or more than $32 billion dollars.

If you want me to dig deeper into on-chain data showing what each cohort of ETH holders are doing, just leave a request in the comments and I’m happy to follow up.

Speaking of liquid staked derivatives, FRAX ($FXS) had a bit of a set-back after topping out at $14.20 on Feb 8. As you probably will remember, mid-Feb through March was quite a rollercoaster for the entire crypto market and FXS wasn’t spared from the bloodbath.

Looking at data from Frax’s dashboard we can see that:

ETH staked in Frax (sFRXETH) still offers a higher yield than staking in ETH2 currently offers (5.64% vs 4.9%)

Traders also have the option to mint frxETH from ETH and then stake this into sfrxETH or farm it in Curve as frxETH/ETH for 6.51% APR.

Similar to the ETH2 contract where an uptick in deposits continues, we see the same dynamic playing out at FRAX.

Currently, there are 127,378 ETH locked in at Frax and the number of validators also continues to rise.

I think the recent downturn in FXS price was a bit of a one-off, and given the pace of network growth and the number of bullish catalysts surrounding ETH and LSDs, I’m sticking with my $16 price target for FXS.

From the perspective of technical analysis, FXS price bounced slightly below the 61.8% Fibonacci retracement and it has recently recaptured the 20-day moving average. The recent pullback also confirmed a lower support test of the previous range high at $7.34.

In the short-term I’ll be watching for a recapturing of the $10.50 range, followed by a daily higher high above $13.

Given the proximity of the ETH Shapella upgrade (April. 12), it’s a good idea to watch and see if the upgrade catalyses a sell-off in ETH and LSD’s because potential low risk, high return opportunities could arise.

Rounded bottom and range break appear as traders anticipate the CKB halving

Speaking of lengthy consolidation, $CKB has been range-bound for nearly 311 days, but recent murmurs about its upcoming block reward halving in 7 months and 23 days could be a potential catalyst behind its recent attempts at a range break.

While there’s not much to say about it at the moment, neither was there for $JOE and $LTC. The volume uptick occurs before the announcement, and the first one or two strong breakouts are eventually what lure in speculators.

Perhaps it’s a sign of things to come.

The important thing to remember is, just like a frozen brisket, bear markets take a lot of time to thaw, but while waiting, it's a good time to get your rub together, put the right materials in place and plan out your investment thesis so you’re ready to cook when the grill is hot.

Follow my grilling adventures and trades @big_smokey1 on Twitter.

The views expressed here are not intended to serve as trading advice. The author is not paid to analyze any of the assets mentioned above and know that I may or may not hold positions in the mentioned assets. Please be safe and DYOR.