Meat glue doesn’t make a better steak

Curve the Merge? The Ethereum trade is getting crowded, but there’s plenty of opportunity elsewhere.

The theme of the last month was confluence and continuation and this ongoing trend continues to back my thesis for swing trading and price agnostic multi-year longs. I primarily use momentum trades to raise funds (USDT) for a war chest and eventually a small portion of these funds go into speculative high risk trades and occasionally leverage, but from my perspective, we’re not in the ideal “risk-on”climate for crypto. I know, it's hilarious to describe anything in crypto as risk-off given the eye popping volatility of even the larger market cap assets, but if you’re crypto native and a trader you’ll catch my drift.

From April through July, the market was deeply oversold and many assets were more than 2 standard deviations away from their average range. As discussed in great detail by Glassnode, multiple key on-chain metrics for Bitcoin’s valuation were also at extreme, multi-year lows, which makes a strong case for accumulating BTC in its current range.

Thus, from a very simplistic point of view, oversold markets eventually bounce (or experience a mean reversion) and assets which investors might have found too pricey four months ago are now trading at multi-year lows. Some even dropped back to their 2017 bull market all-time highs. In theory, for many of these tokens (like Ethereum), nothing has fundamentally changed, except for price.

The most recent bull market built up A LOT of leverage, and DeFi’s dangerously addictive double dipping synthetic staking and other ponzinomics style projects are probably partially responsible for some of the wild price rallies we saw in altcoins in 2021-2022. So, a simple way of viewing the market, (purely from a trading perspective) is to identify assets that were darlings in 2021, that are now trading way off their average value and play those oversold bounces or open long positions and take profits at the 200-day moving average, 38.2% and 61.8% Fibonacci level.

That’s the short-term thesis propelling the last two articles analyzing altcoins and Bitcoin price action, but that trend is getting a little long in the tooth and as an investor, there’s a lot more going on than just “trading.” Right now, everyone is waiting for BTC to flip $24K to support in order to open fresh longs and an uncountable number of ETH Merge strategies have “emerged”, which is why I titled this one, “meat glue doesn’t make a better steak.”

It’s true, meat glue allows one to take less than prime cuts and assemble them into the most beautiful prime rib with wagyu-like features, but it doesn’t make a higher quality steak and the discerning consumer will notice the lack of texture and consistency.

Staying abreast of the current narratives and emerging trends is also part of the game, but having a diverse set of strategies is more important than planting a seed in every pot. Right now smart money and retail traders are purely focused on the ETH merge narrative and how to position.

Should retail traders curve the merge?

Let’s investigate what’s on the market menu at the moment.

3 racks of baby back and St. Louis ribs with a standard Texas-style dry rub ready to spend 7 hours smoking over a Post Oak and Cherry wood mix. Mustard is the binder if you’re curious. Oh the tender, sweet memories…

Anyhow, back to the task at hand.

Will the Ethereum Merge be a buy the rumor, sell the news-style event?

DeFi got washed out completely. Now that the leverage is gone, let's see where the money flows are and what unique experimental financial models emerge. To do this one would need to leave some powder dry at the ready.

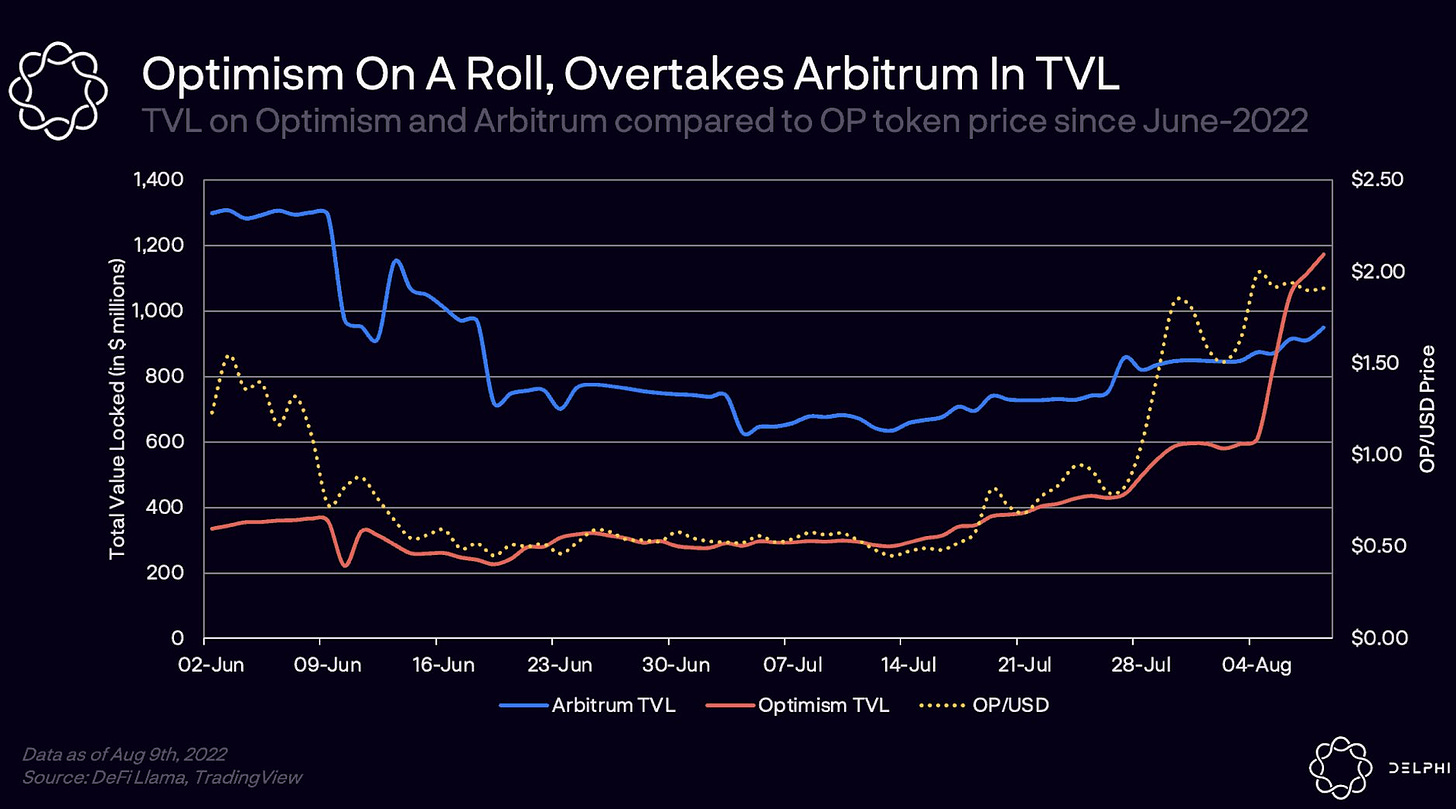

The ETH Merge is already triggering a healthy amount of FUD and hardfork civil wars could again place focus on L2 solutions. For example, Optimism (OP) is doing multiples, why?

Arbitrum might drop a token to users, MAGIC token appears to have bottomed. Any sort of problems in the ETH Merge could disrupt the stability of the entire crypto market, possibly catalyzing BTC to revisit swing lows, if not lower, and break the current consolidation phase the market is in now. Alternatively, a successful the Merge could also concurrently redirect inflows to Optimism, Arbitrum and other L2 solutions.

Maybe L2 won’t fare so well. What if the Merge proves to be a disaster? It's possible that ETH holders will want to pull wETH (wrapped ETH) from L2 platforms and in a hurry. That means it's got to come through cross-chain bridges, because the Arbitrum bridge can take at least 7 days.

ETH hodlers might also want to come back to L1 ETH to get larger hardfork allocations that can be sold on supporting exchanges. Perhaps ETH inflows to exchanges will rise as speculators come out of L2 to qualify for hardfork allocations? Again, unless one is waiting 7 days to exit Arbitrum through its bridge, a faster cross chain bridge solution will be necessary.

While the past few months have shown that cross-chain bridges are susceptible to catastrophic hacks, these alternate solutions like Multichain (MULTI), Celer Bridge (CELR) and the Ren Bridge (REN) might be the go to solutions. Do these cross-chain bridges have tokens? Why yes they do and they’re all flashing bottoming signs.

What will all that rushed inflow mean for the token price? Are there perpetual contracts for these bridge tokens? How can you play them? As an example, when the Nomad bridge got hacked, what happened to EVMOS price? The key is flow. Perhaps the Merge will catalyze cross-chain movement and bridge tokens could stand to be the beneficiaries of this flow.

Long story short, there’s a ton of narratives out there. All worthy of consideration and a well thought out plan. Now is not the time to ape, it's time to dollar cost average (DCA), identify assets with the strongest trends and make plans, while also having sufficient dry powder for any of those events that happen to materialize.

By the way, if you’re enjoying this post, then why don’t you subscribe? The newsletter comes out twice per month so it won’t be too much of a heavy lift!

So, in a multi prong approach, so far we have:

Swing trading oversold assets and going long on those with bullish higher timeframe technical analysis patterns as they approach the 200-day MA and fill VPVR gaps.

Research and brainstorm emerging trends in DeFi (track inflows) and think about upcoming narratives and how they could be played. (ETH merge hard forks, cross chain bridges)

There’s more to investing than trading

Mining is another area to consider that is emerging as an investment opportunity. The Bitcoin mining industry took quite a blow as BTC price collapsed from $69,800 to $17,600 and this has translated to a drastic drop in ASIC (the computers miners use to mine) prices.

Data shows a beta correlation between ASIC prices and Bitcoin price and I’ll assume the same for Ethereum and altcoin miners versus token pricing.

Bitcoin ASIC Price Index. Source: Hashrateindex.com

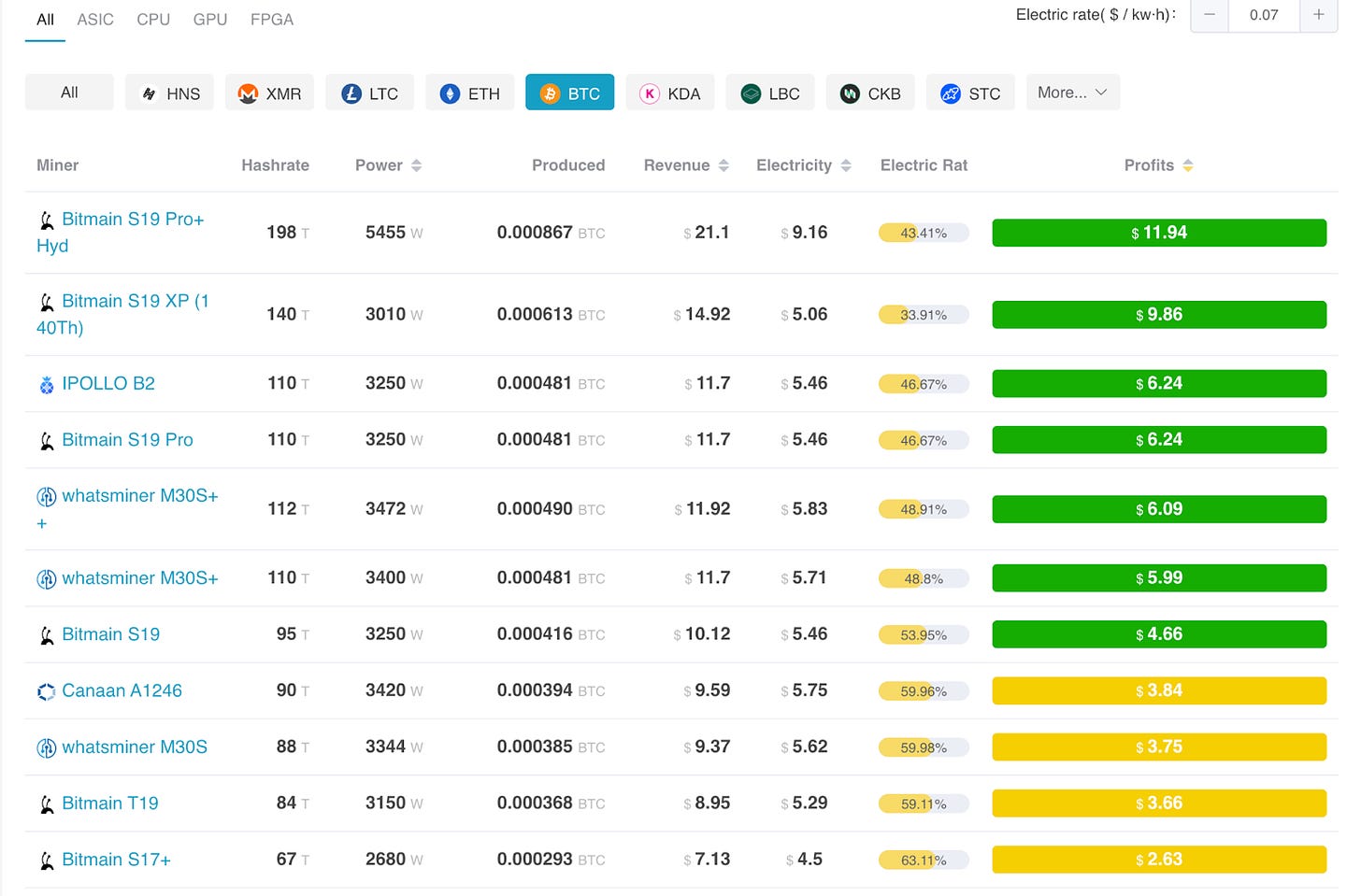

Many top tier ASICs are down 70% from their all-time high 2021 bull market prices, and a speculative play would be to buy these miners cheap and sell them in deep profit as BTC price eventually rises. If you happen to live in a place that has sub $0.07 cent per k/w electricity rates, you could also turn them on and profitably mine.

If not, one could simply buy ASICs, leave them boxed up, and flip them when BTC price eventually regains steam. Of course, a good deal of research is required before attempting this strategy.

For example, Bitmain S19 XPs are out now and industrial miners will be firing them up as the summer months pass. Bitmain also has the S19 Hydro. The XP runs 140 th/s, the Hydro up to 198 th/s and good God almighty, imagine what might happen if these units are overclocked!

With more powerful tier 1 ASICs hitting the market in 2022 / 2023, it's possible that the premium S19j Pros and M30s++’s commanded in 2021 may not exist in late 2022 and 2023.

All investing requires stern risk management, and in Bitcoin mining and ASICs, risk management is the main factor that determines whether one is profitable or REKT.

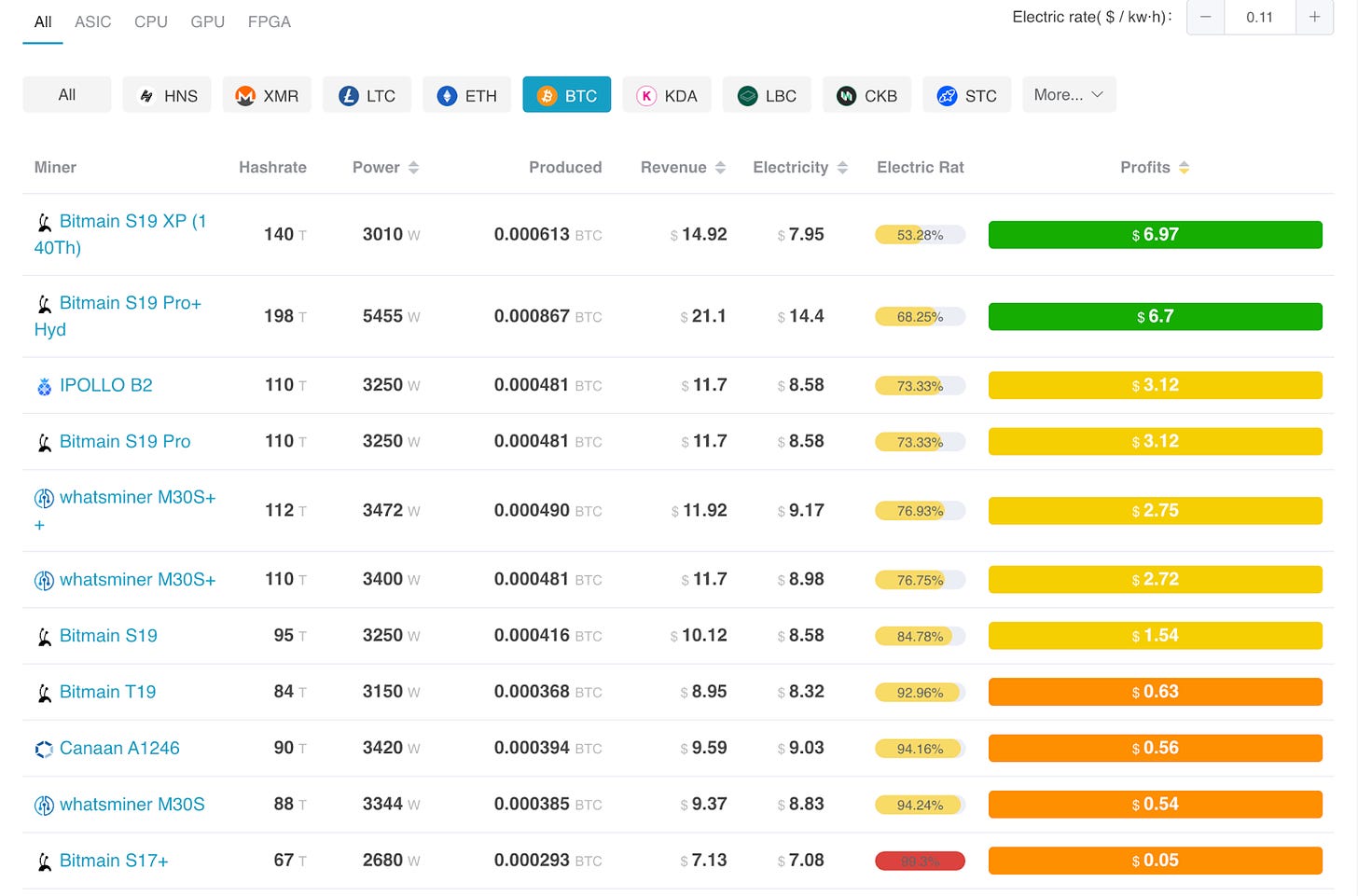

For retail investors with home electricity rates in the $0.11+ k/w zone, the operational cost of mining Bitcoin will outweigh the profits in the current price range. One would essentially be paying about $400 to $500 in electricity per month, needing to solve the noise and heat produced by ASICs and finding a way to keep them cool during this brutal US and EU summer heatwave, just to generate $3 to $7 per day in BTC on machines that cost $5,000 to $9,000 each!

This means, unless one is willing to colocate and can meet the minimum order quantity requirement and duration of contract (usually 5 ASICs contracted for 1 to 2 years), it sounds easier and wiser to just buy spot BTC doesn’t it?

Fortunately, BTC isn’t the only cryptocurrency one can mine. Kadena (KDA) was another standout performer in 2021, and like Bitcoin ASICs, Kadena Goldshell miners have also seen a 70% to 80% drop in value as the token fell from an all-time high at $28, all the way down to $1.39.

At the time of writing, KDA was trading for $2.15, and as mentioned in previous analysis, the rounding bottom, increasing volume, and recent launch of Kaddex and other ecosystem developments could see the token price stage a reversal.

Shown above is data from DXPool reflecting the profitability of KDA miners at a $0.11 per kilowatt electricity cost. Imagine what happens if KDA price turns bullish again? Not only does miner profitability rise, but so does the value of the ASICs thanks to the beta correlation.

Be wary of popular narratives and their narrator

The moral of the story here is, diversification is everything and when everyone is looking in one direction and magnetized by the allure of the narrative du jour, it could be wise to look the other way and identify opportunities that are being slept on.

It’s possible that the “confluence, consolidation and continuation” market trend is coming to an end, and it looks like the Merge will be the catalyst that activates a strong directional move in the market.

Don’t get pulled out to sea by the rip tide and don’t be fooled into giving up your hard earned money for a steak built out of meat glue.

Follow my grilling adventures and trades @big_smokey1 on Twitter and see my pnl from the $500 starter account.

The views expressed here are not intended to serve as trading advice. The author is not paid to analyze any of the assets mentioned above and know that I may or may not hold positions in the mentioned assets. Please be safe and DYOR.